Fly Fishing Is Not Slowing Down: Spending Patterns Are Becoming More Segmented

- The Fly Box LLC

- Jan 22

- 3 min read

This FREE feature is brought to you by Casts That Care. Casts That Care is the daily fly fishing charity news published by The Fly Box LLC, sharing real stories, conservation updates, and community features that give back to the waters we love.

If you enjoy this piece, you can read over 300 more articles plus new ones every day and subscribe here. Each month we donate 50 percent of all subscriptions to a different fly fishing charity.

Participation Remains Broad

Outdoor recreation participation in the United States remains at historically high levels. In 2024, 181.1 million Americans, nearly 59 percent of the population, participated in outdoor recreation. Fishing continues to rank among the most accessible outdoor activities, and fly fishing remains a visible segment within that landscape.

More than 57 million Americans went fishing in 2024, marking another record year. Within that group, fly fishing participation exceeded 8 million anglers for the second consecutive year. These figures indicate that the overall participation base remains substantial and that fly fishing continues to attract a meaningful audience.

This scale of participation suggests that engagement with the sport is not contracting. Instead, changes are occurring in how anglers choose to allocate discretionary time and spending.

The Economic Footprint of Fishing

Sport fishing continues to represent a significant economic force. In 2025, the sport fishing industry contributed more than $230.5 billion annually to the United States economy and supported approximately 1.1 million jobs nationwide.

This economic footprint spans equipment manufacturing, retail, guiding, travel, hospitality, and conservation work. The size of the sector reinforces that fishing remains embedded in the broader outdoor economy even as spending behavior evolves.

A Shift in Consumer Spending Behavior

While participation remains strong, consumer behavior across discretionary categories has shifted in 2025. National economic research shows households prioritizing essential expenses while becoming more selective about discretionary purchases.

Recent consumer data indicates that spending has not disappeared, but has become more targeted. Rather than frequent routine purchases, consumers are concentrating spending on experiences and products that carry higher perceived value.

Within the outdoor industry, this trend is reflected in data showing that

casual and active lifestyle participants account for more than 90 percent of total outdoor market spending.

Spending is therefore distributed broadly across participants rather than concentrated among a narrow group of high frequency buyers.

Evidence of Spending Segmentation

When applied to fly fishing, current data supports a segmented spending pattern rather than a uniform slowdown. Three observable behaviors emerge.

Entry level participation remains active. Affordable gear, local access, and education programs continue to support new anglers entering the sport.

Premium experiences continue to attract demand. Guided trips and destination travel remain priorities for anglers who choose to concentrate spending into fewer, higher value experiences.

Mid range discretionary spending has become more selective. Anglers appear to be extending the lifespan of existing gear, reducing frequency of routine purchases, and evaluating purchases more carefully.

This pattern mirrors broader trends seen in travel, retail, and leisure markets, where premium and entry categories show resilience while mid tier volume softens.

Retail and Engagement Implications

Selective spending alters how anglers interact with the sport. When purchasing slows but participation remains steady, engagement shifts away from frequent product turnover and toward experience based involvement.

This includes greater emphasis on instruction, guiding, local fishing opportunities, and efficient use of existing equipment. These behaviors reflect prioritization rather than disengagement.

Such patterns are consistent with broader value seeking behavior documented across discretionary consumer categories in 2025.

Access and Community as Stabilizing Forces

As spending becomes more segmented, programs focused on access, education, and conservation take on greater functional importance. Organizations that reduce barriers to entry or provide structured engagement support help maintain participation during periods of economic caution.

Community based initiatives, nonprofit programs, and conservation focused efforts play a stabilizing role by sustaining involvement without relying on high frequency consumer spending.

Structural Change, Not Decline

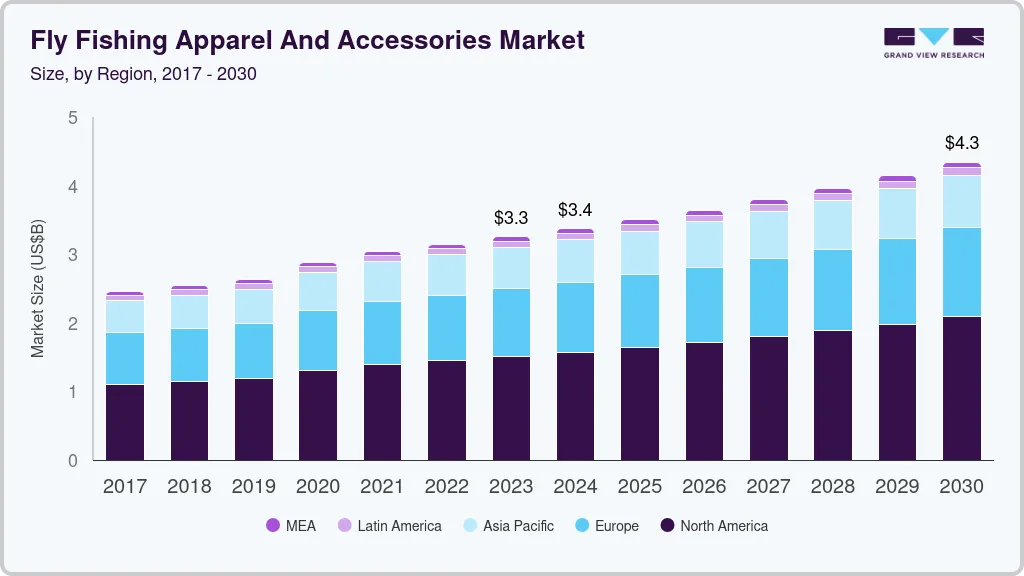

The available data does not support the conclusion that fly fishing is experiencing a broad contraction. Participation levels remain high, the economic footprint is substantial, and market projections remain positive.

What has changed is how discretionary dollars are allocated. Spending patterns are becoming more segmented, reflecting wider economic behavior rather than a loss of interest in the sport.

Fly fishing is not shrinking. It is reorganizing around participation, value, and intentional engagement.

This FREE feature is brought to you by Casts That Care. Casts That Care is the daily fly fishing charity news published by The Fly Box LLC, sharing real stories, conservation updates, and community features that give back to the waters we love.

If you enjoy this piece, you can read over 300 more articles plus new ones every day and subscribe here. Each month we donate 50 percent of all subscriptions to a different fly fishing charity.

Comments